OUTSOURCING

Meaning & Definition

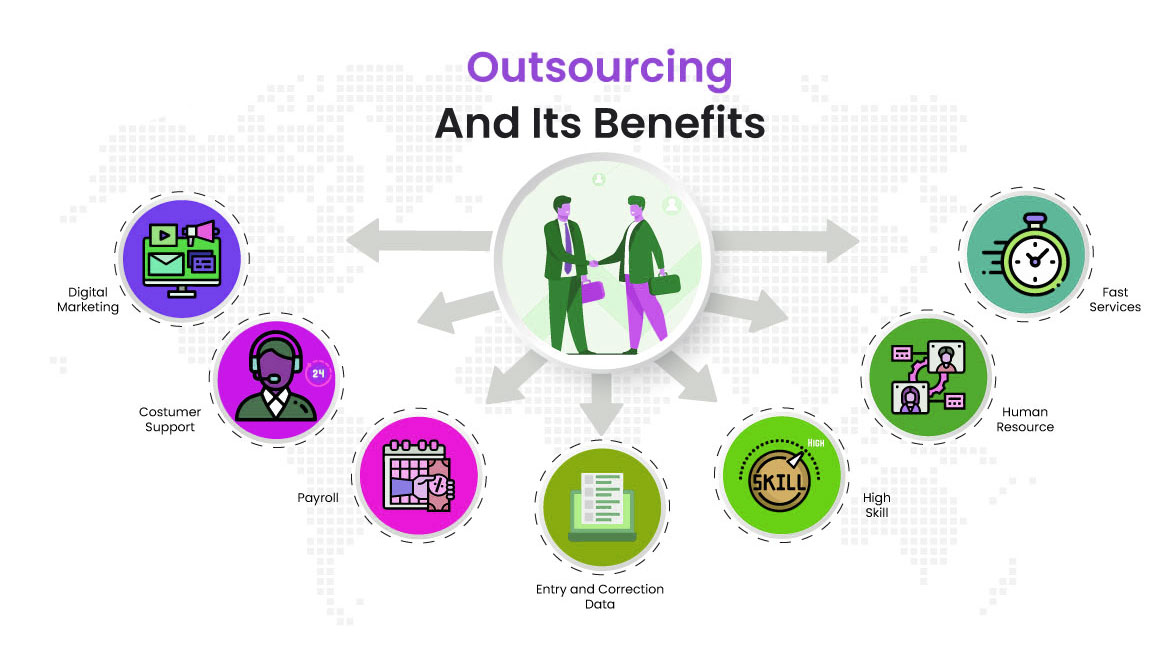

Outsourcing is a business practice where a company contracts out certain tasks or functions to external service providers rather than handling them in-house. This is often done to reduce costs, access specialized skills, improve efficiency, and focus on core business activities. Outsourcing can involve various business functions, including information technology (IT), customer support, manufacturing, human resources, and more.

Key Aspects Of Outsourcing:

- Cost Savings : Outsourcing is often pursued to reduce operational costs. Companies can benefit from lower labor costs, economies of scale, and access to specialized expertise without having to invest in extensive in-house resources.

- Specialized Skills : Outsourcing allows companies to tap into the specialized skills and knowledge of external service providers. This is particularly beneficial for tasks that require specific expertise, such as software development or digital marketing.

- Focus on Core Competencies : By outsourcing non-core functions, companies can concentrate on their core competencies and strategic activities. This can lead to increased innovation and competitiveness.

- Flexibility and Scalability : Outsourcing provides flexibility, allowing companies to scale their operations up or down based on business needs. This is especially valuable in industries with fluctuating demand.

- Globalization: Outsourcing often involves working with service providers located in different geographic locations, contributing to the globalization of business operations.

- IT Outsourcing Companies : These companies provide services such as software development, IT support, network management, cybersecurity, and more.

- Business Process Outsourcing (BPO) Companies: BPO companies handle specific business processes, including customer support, data entry, human resources, finance and accounting, and other back-office functions.

- Manufacturing Outsourcing Companies : Companies that outsource manufacturing processes to external suppliers, often in different countries, to reduce production costs.

- all Center Outsourcing Companies: Specialize in providing customer support, telemarketing, and related services through call centers.

- Research and Development (R&D) Outsourcing Companies : These companies offer R&D services to help clients with product development and innovation. When choosing an outsourcing partner, companies typically consider factors such as the provider's reputation, track record, quality of service, security measures, and cost-effectiveness. Effective communication and a well-defined contractual agreement are crucial to ensuring a successful outsourcing relationship.

- Outsourcing Accounts:

• Bookkeeping: Outsourcing bookkeeping services involves the maintenance of financial records,

including recording transactions, preparing financial statements, and reconciling accounts.

• Payroll Processing: Many companies outsource payroll processing to ensure accurate and timely payment of employees, compliance with tax regulations, and proper record-keeping.

• Accounts Receivable and Payable: Managing accounts receivable and payable, including invoicing, tracking payments, and handling vendor bills, can be outsourced to improve efficiency. - Outsourcing Finance:

• Financial Analysis and Reporting: Outsourcing financial analysis and reporting services can

help businesses make informed decisions based on comprehensive financial insights.

• Budgeting and Forecasting: Some companies outsource the budgeting and forecasting processes to ensure a more strategic and objective approach to financial planning.

• Financial Planning and Analysis (FP&A): FP&A functions, such as variance analysis, scenario planning, and strategic financial planning, can be outsourced for improved resource utilization. - Outsourcing Taxation:

• Tax Preparation and Filing: Outsourcing tax preparation services involves entrusting a third

party with the responsibility of preparing and filing tax returns, ensuring compliance with tax

laws.

• Tax Planning: Companies may outsource tax planning services to optimize their tax positions, identify tax-saving opportunities, and stay abreast of changes in tax regulations.

• Compliance: Ensuring compliance with local and international tax regulations is critical. Outsourcing this function can help companies navigate complex tax laws efficiently. - Cost Savings: Outsourcing allows businesses to access skilled professionals at a fraction of the cost of maintaining an in-house team.

- Expertise: Outsourcing firms often specialize in accounting, finance, and taxation, bringing a high level of expertise to the table.

- Focus on Core Business: By outsourcing non-core functions, companies can concentrate on their core business activities and strategic objectives.

- Scalability: Outsourcing provides scalability, allowing businesses to adjust the level of service based on their needs and growth.

- Risk Mitigation: Outsourcing partners are often well-versed in compliance and regulatory requirements, helping businesses mitigate the risk of errors and non-compliance.

- Technology Integration: Outsourcing firms often leverage advanced accounting and finance technologies, providing clients with access to the latest tools without the need for significant investments.

OUTSOURCING COMPANIES

Outsourcing companies, also known as service providers or third-party vendors, specialize in delivering specific services to client organizations. These companies offer expertise, infrastructure, and resources in areas that may not be the client's core focus. There are outsourcing companies across various industries and sectors, providing a wide range of services. Some common types of outsourcing companies include:

OUTSOURCING ACCOUNTS , FINANCE AND TAXATION

Outsourcing accounts, finance, and taxation functions is a common practice among businesses looking to

streamline their operations, enhance efficiency, and focus on their core competencies. Here's an

overview of outsourcing in the context of accounts, finance, and taxation:

Outsourcing accounts, finance, and taxation functions is a common practice among businesses looking to

streamline their operations, enhance efficiency, and focus on their core competencies. Here's an

overview of outsourcing in the context of accounts, finance, and taxation:

.

Benefits of Outsourcing Accounts, Finance, and Taxation:

When outsourcing accounts, finance, and taxation functions, it's crucial to choose a reputable and reliable outsourcing partner. Effective communication, a clear understanding of expectations, and a well-defined service level agreement (SLA) are essential for a successful outsourcing relationship. .

Get In Touch

Get A Quick Call Back From Our HR Recruitment Agency Experts